ABOUT GBC

Welcome to Great Basin College!

Great Basin College values you! Valuing what we have in common and our differences means we will foster a college climate of mutual trust, tolerance, informed discourse and always seek to promote GBC as a "safe space" to explore new ideas and perspectives with opportunities for you to grow, learn and be successful in a friendly, supportive campus environment. GBC enriches people's lives by providing student-centered, post-secondary education to rural Nevada. GBC students enjoy outstanding academic programs, smaller class sizes, and excellent faculty who really care about our students. We are GBC!

ADMISSIONS

ACADEMICS

For High School Students

STUDENT SERVICES

Great Basin College is "The Gold Standard in the Silver State" when it comes to long-distance education and online education delivery. GBC offers hundreds of classes and a diverse array of certificate and degree programs fully online and fully affordable!

COMMUNITY

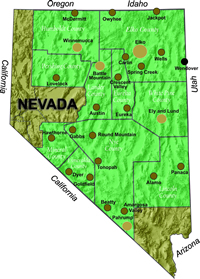

Great Basin College wants to be your choice for higher education. GBC offers associate and baccalaureate level instruction in career and technical education and academic areas. About 4,000 students are enrolled annually online from across the country and on campuses and centers across 86,500 square miles, two time zones, and ten of Nevada's largest counties. We border Arizona, Oregon, Idaho, Utah, and California. We are GBC!

INFORMATION

Need to find COVID-19 information quick? Check out our Coronavirus (COVID-19) Information and Resources page!

QUESTIONS? CONTACT US!

Great Basin College Foundation

1025 Chilton Circle

P.O. Box 2056

Elko, NV 89803

Phone: 775.327.2382

Email: gbcf@gbcnv.edu

STAY IN TOUCH!

Non-cash Giving

An in-kind donation is a gift of tangible personal property, such as machinery, books, computers, etc. Services and volunteer time do not qualify as in-kind donations under this policy. Great Basin College Foundation coordinates all donations to Great Basin College, including in-kind donations.

An in-kind donation is a gift of tangible personal property, such as machinery, books, computers, etc. Services and volunteer time do not qualify as in-kind donations under this policy. Great Basin College Foundation coordinates all donations to Great Basin College, including in-kind donations.

In-kind gifts to Great Basin College must be directed through the Great Basin College Foundation. College employees or Board members who receive offers of equipment, property or services must

consult the Foundation office at 775.327.2382. Additionally, the donor must complete our In-Kind Giving Form prior to gift acceptance.

consult the Foundation office at 775.327.2382. Additionally, the donor must complete our In-Kind Giving Form prior to gift acceptance.

These gifts are subject to acceptance by the Executive Director of the Foundation and/or the Foundation’s Development Committee.

Foundation staff considers several issues before accepting an in-kind gift:

- Does the college have a need for the donated item?

- Does the gift obligate the Foundation/College to financial commitments in excess of budgeted items or other obligations disproportionate to the use of the gift? These could include, but are not limited to environmental remediation, upkeep expenses, insurance liabilities, and display, delivery, or space requirements for storage or exhibition.

Gift Appraisals (Federal Tax Documentation)

All charitable contributions require various types of documentation to meet institutional and IRS requirements. In-kind donations involve more extensive documentation than contributions of cash. Neither the Foundation nor the College places a value on donations for federal tax purposes. When in-kind gifts are given to the Foundation with the intent of the donor to receive a tax deduction, it is the responsibility of the donor, not the Foundation, to obtain an appraisal of the gift for tax purposes. Internal Revenue Service policy does not allow the charity issuing the receipt to become involved in the appraisal process. Please complete our In-Kind Giving Form prior to gift acceptance.

Note to Our Donors

Your gift to the Great Basin College Foundation may affect your financial situation. We do not provide legal or financial advice. Consult your attorney or tax professional, before planning or making a gift.

For More Information Contact

Great Basin College Foundation Office

Phone: 775.327.2382

Email: gbcf@gbcnv.edu

Why Great Basin College

Great Basin College offers associate and baccalaureate level education in academic, career and technical fields. Welcoming students from all corners of the country, both online and at our various campuses and centers, GBC's presence extends across two time zones and spans more than 86,000 square miles throughout Nevada. A leader in rural higher education, GBC takes pride in developing students who are well-prepared to meet the demands of industry and who contribute to the success and prosperity of the local economy.